Get the free oklahoma direct deposit enrollment form

Show details

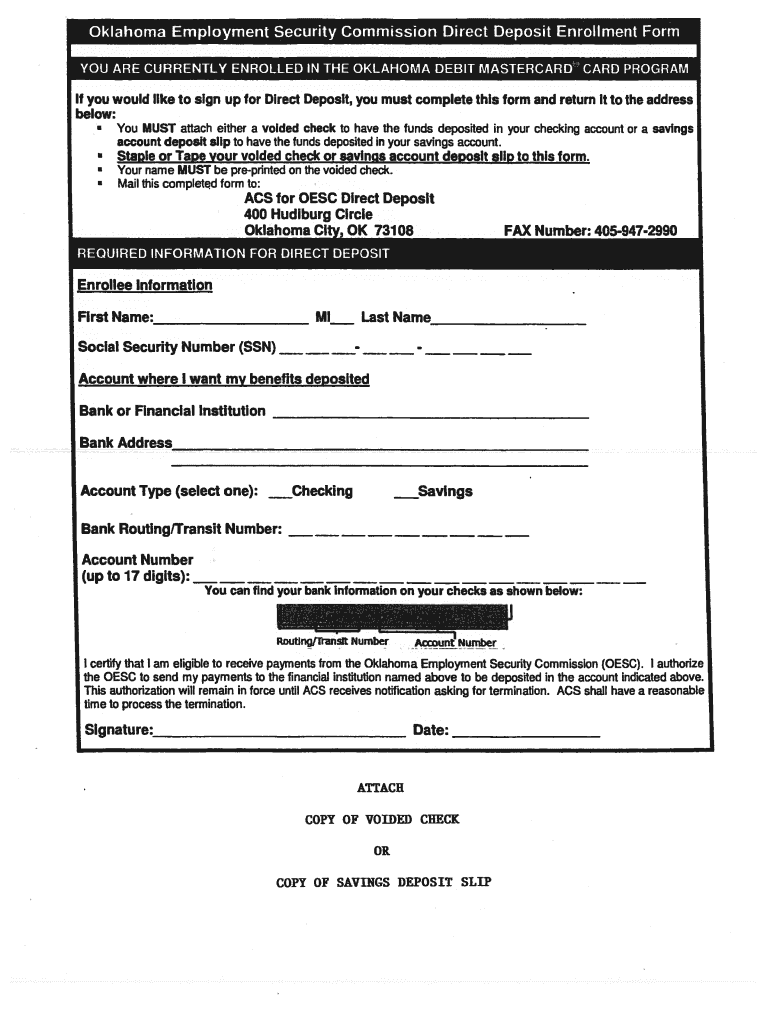

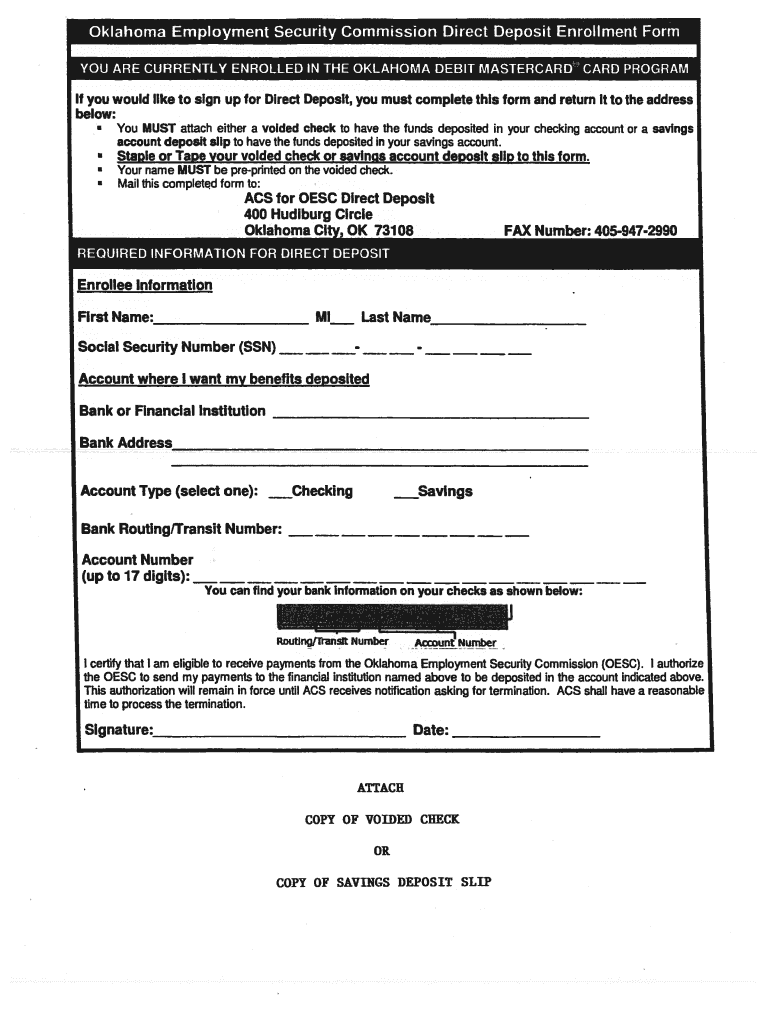

If you would like to sign up for Direct Deposit, you must complete this form and rectum it to the address

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

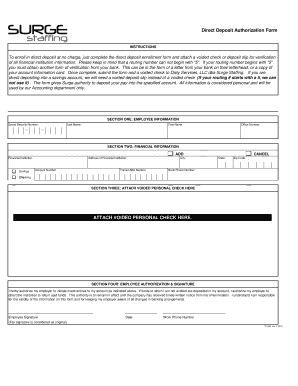

Edit your oklahoma direct deposit enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma direct deposit enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma direct deposit enrollment form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma unemployment direct deposit form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

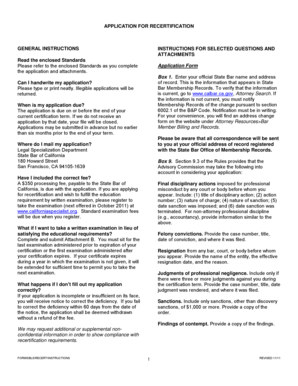

How to fill out oklahoma direct deposit enrollment

How to fill out Oklahoma direct form:

01

Obtain the Oklahoma direct form from the appropriate source. It may be available online or at a local government office.

02

Start by reading the instructions carefully. Familiarize yourself with the requirements and any supporting documents that need to be submitted along with the form.

03

Begin by providing your personal information such as your full name, address, contact details, and Social Security Number.

04

Follow the instructions to accurately fill out each section of the form. Pay close attention to any specific formatting or information that needs to be included.

05

Provide all the necessary details regarding your income, deductions, and credits. Ensure the information is accurate and supported by relevant documentation if required.

06

Double-check the form for any errors or omissions. It is essential to review your responses to ensure accuracy and completeness.

07

Sign and date the form as instructed. If applicable, ensure any additional signatures from a spouse or dependents are obtained.

08

Make a copy of the completed form for your records before submitting it.

09

Submit the Oklahoma direct form by the designated method, which could be via mail, online submission, or in person at a government office.

10

Keep a record of the submission, including any confirmation numbers or receipts, in case you need to track the progress of your form or prove that it was filed accurately.

Who needs Oklahoma direct form:

01

Oklahoma residents who have income earned in Oklahoma and need to report it on their state tax return.

02

Individuals who are eligible for certain tax credits or deductions offered by the Oklahoma tax system and need to claim them on their tax return.

03

Anyone who has been instructed or advised by the Oklahoma tax authorities to complete and submit the Oklahoma direct form in specific situations, such as when additional reporting is required.

Fill oklahoma employment commission direct deposit form : Try Risk Free

People Also Ask about oklahoma direct deposit enrollment form

How do I find out if I owe Oklahoma state taxes?

Where is my Oklahoma state refund?

How to change direct deposit for oklahoma teachers retirement?

How long do you have to be vested in Oklahoma for teachers retirement?

How do I withdraw money from my Oklahoma teacher retirement?

How do I contact Oklahoma tax Commission?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oklahoma direct form?

Oklahoma Direct Form is an online form used to apply for various public assistance programs in the state of Oklahoma. It is designed to make it easier and faster for people to apply for benefits, including SNAP (food stamps), TANF (Temporary Assistance for Needy Families), Medicaid, and WIC (Women, Infants, and Children nutrition program).

How to fill out oklahoma direct form?

1. Enter the required information in the form. You will need to provide your name, address, and Social Security number.

2. Select the program that you are applying for.

3. Provide any additional information that is requested. This may include income information, current employment information, and any other information that is relevant to the program you are applying for.

4. Sign and date the form. You must also provide your signature in order for the form to be processed.

5. Submit the form to the Oklahoma Department of Human Services. You can do this online, by mail, or in person.

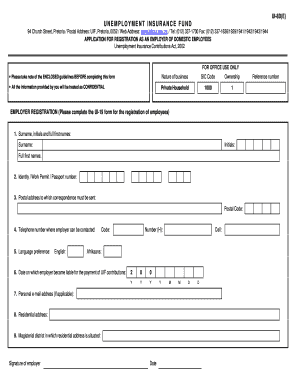

What information must be reported on oklahoma direct form?

The Oklahoma Direct Form requires employers to report the following information:

• Employer name and address

• Employer FEIN

• Employee name and address

• Employee Social Security Number

• Employee date of birth

• Employee job title

• Employee gross wages for the quarter

• Employee withholding allowance

• Federal and state income taxes withheld

• Social Security and Medicare taxes withheld

• Any other deductions or contributions

What is the penalty for the late filing of oklahoma direct form?

The penalty for the late filing of an Oklahoma Direct Form is a $25 late fee. This fee must be paid in addition to the filing fee.

Who is required to file oklahoma direct form?

The Oklahoma Direct Form, also known as Form 511-DIR, is required to be filed by individuals who are Oklahoma residents and have earned income from sources outside of Oklahoma. This form is used to calculate and report income taxes owed to the state of Oklahoma on the out-of-state income.

What is the purpose of oklahoma direct form?

The purpose of the Oklahoma Direct Form is to allow Oklahoma residents to elect to have their wages exempt from withholding tax. By completing and submitting this form to their employer, individuals can let the employer know not to withhold state income tax from their wages. This is usually done when an individual expects to have no Oklahoma tax liability or if they meet specific qualifications specified by the Oklahoma Tax Commission. Ultimately, the Oklahoma Direct Form allows taxpayers to adjust their withholding status to align with their anticipated tax obligations.

How can I send oklahoma direct deposit enrollment form to be eSigned by others?

When your oklahoma unemployment direct deposit form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I edit oklahoma direct form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign oklahoma employment direct deposit form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out oklahoma employment commission form on an Android device?

On Android, use the pdfFiller mobile app to finish your ok direct deposit form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your oklahoma direct deposit enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Direct Form is not the form you're looking for?Search for another form here.

Keywords relevant to oklahoma security deposit form

Related to oklahoma unemployment direct deposit get

If you believe that this page should be taken down, please follow our DMCA take down process

here

.